what is the income tax rate in dallas texas

There is no applicable county tax. Business income tax rates are based on a companys total earnings reduced by the operating costs and other capital expenses.

What Business Owners In Dallas Need To Know About Irs Payroll Tax Payroll Taxes Irs Taxes Payroll

Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023.

. The other one percent is used for General Fund services. Collin Dallas Denton Ellis Hunt Kaufman and Rockwall. The HUD definition.

This is the total of state county and city sales tax rates. Only the Federal Income Tax applies. 2020 HUD Income Limits.

No Tax Due Threshold. Texas has no state-level income taxes although the Federal income tax still applies to income earned by Texas residents. - Texas State Tax.

New employers should use the greater of the average rate for all employers in the NAICS code or use 27. Filing 12000000 of earnings will result in 1980900 of that amount being taxed as federal tax. Both Texas tax brackets and the associated tax rates have not been changed since at least 2001.

If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental wages separately and tax them at that 22 rate. The member will pay income tax on the profits at their individual tax rate as well as an additional 153 in self-employment taxes social security and medicare. Tax Rate retail or wholesale 0375.

Texas has no state income tax. This marginal tax rate means that your immediate additional income will be taxed at this rate. The Dallas sales tax rate is.

Data will be updated to current. Texas has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. By Dallas Morning News Editorial.

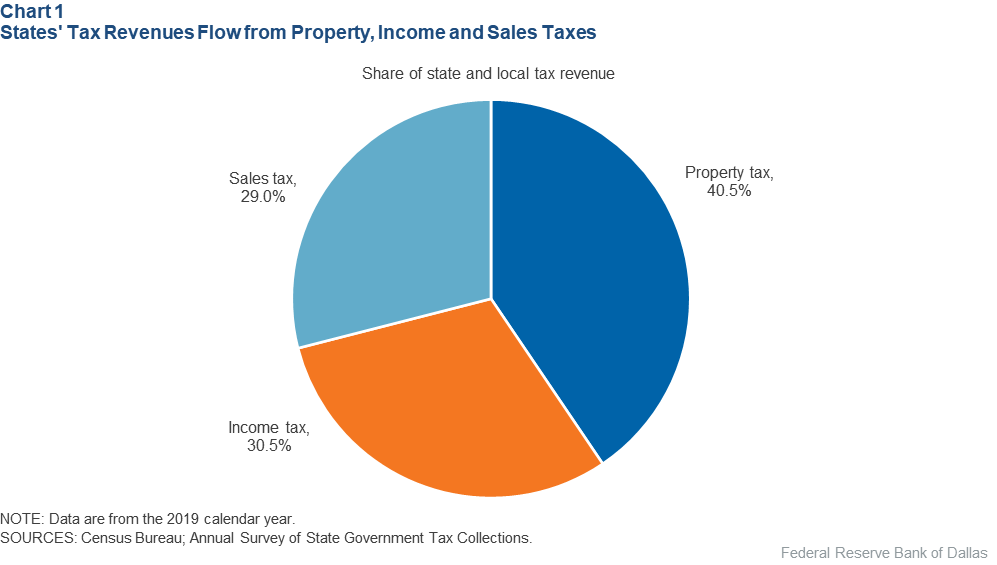

Wayfair Inc affect clean_state. One percent of what the City collects goes to Dallas Area Rapid Transit or DART. However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas property tax.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. - FICA Social Security and Medicare. However businesses primarily engaged in retail and wholesale trade can use a franchise tax rate of 0375 which reduces the tax by 50.

The state is among seven states that levy no individual income tax on their residents. Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax. Texas Is Income Tax Free Texas is one of seven states with no personal income tax.

EZ Computation Total Revenue Threshold. Texas is one of seven states that do not collect a personal income tax. Filing 12000000 of earnings will result in 918000 being taxed for FICA purposes.

The Texas sales tax rate is currently. HUD literature refers to the 80 of AMFI standard as low income and the 50 standard as very low income. Texas state income tax rate table for the 2021 - 2022 filing season has zero income tax brackets with an TX tax rate of 0 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

They can either be taxed at your regular rate or at a flat rate of 22. The Dallas sales tax rate is. The Dallas TX HUD Metro FMR Area consists of the following counties.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. To see the change in sales tax revenue over time check out Sales Tax History below. The 2018 United States Supreme Court decision in South Dakota v.

The base sales tax in Texas is 625. Tax Bracket gross taxable income Tax Rate 0. The violent crime rate in Terrell Hills is 183 per 100000 people compared to Texas rate of 4389 per 100000 people.

W Houston TX 77070. CAZ CREEK TX LLC Houston 118 Vintage Park Blvd No. The County sales tax rate is.

Ad Compare Your 2022 Tax Bracket vs. Texas corporations still however have to pay the federal corporate income tax. The richest city in Texas is Terrell Hills where the population is just over 5000 and the median cost of a home is 557600 and the median household income is 174844.

Discover Helpful Information and Resources on Taxes From AARP. Texas will be announcing 2022 tax rate changes in February. Top individual income tax rate in Texas still 0 in 2020.

The top marginal income tax rate for residents of Texas remains the lowest in the nation -- 0 percent -- according to a new study of state individual income tax rates by the Tax Foundation. Your average tax rate is 169 and your marginal tax rate is 297. The minimum combined 2022 sales tax rate for Dallas Texas is.

The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Tax Rate other than retail or wholesale 075. The state of Texas collects 625 on purchases and the City collects another 2 for a total of 825.

The Texas Franchise Tax. 200 AM on Apr 27 2022 CDT. Multifamily Tax Subsidy Project Income Limits.

We provide business formation services across the entire state of Texas including but not limited to the cities of Dallas Fort Worth Houston Austin San. The rate increases to 075 for other non-exempt businesses. Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year.

2022 Tax Rates Estimated 2021 Tax Rates. Your 2021 Tax Bracket to See Whats Been Adjusted. 104 rows TOTAL TAX RATE.

Dallas Mayor Eric Johnson has called for a tax rate cut to keep Dallas competitive with suburban cities. Every 2018 combined rates mentioned above are the results of Texas state rate 625 the Dallas tax rate 1 to 175 and in some case. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Did South Dakota v.

Pin On Real Estate Infographics

School District Map Of Houston Houston Map Houston Zip Code Map Houston Texas Living

Count The Number Of Cars On The Freeways With Ca Ny And Fl License Plates Our Job Market Is The Best In The Country An Texas Infographic Texas Infographic

Who Pays U S Income Tax And How Much Pew Research Center

Texas Income Tax Calculator Smartasset

Pin On La Domain Names La Websites And Use Cases

Here S How Much Money You Take Home From A 75 000 Salary

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Income Tax Calculator Smartasset

When Tax Returns Are Not Filed If You Are Seeking Help Filing Current Tax Returns The Team Of Tax Professionals At Our Firm C Tax Return Tax Help Tax Attorney

Pin On Raymond Gin The Retirement Group

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Https Www Dfwincomeproperties Com Dfw Income Properties Real Estate Sales Dallas Fort Worth Area Reale Multi Family Homes Income Property Foreclosed Homes

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Where Do My Taxes Go H R Block Consumer Math Business Leader Financial Planning

Texas Income Tax Calculator Smartasset

Digital Marketing Company Income Tax Services Income Tax Brackets Tax Services Tax Brackets